The COVID-19 pandemic is a crisis that many of us will never forget in our lifetime; not only is it putting the health and safety of our loved ones at risk, but it also presents tough economic challenges that will threaten many businesses around the world. The global automotive industry is not exempt from this; as factory shutdowns worldwide signal challenging times ahead.

So what does this mean for Philippine car buyers?

Ultimately that question is tied to the longevity of the crisis on both a local, regional and global scale. Aside from the immediate health risks, COVID-19 is presenting uncertainty worldwide with regard to people’s employment and income. If the crisis endures for a sustained period of time, this may very well affect consumer buying power and as a result, contribute to deteriorating new car sales. Should this occur, then we may also see a lot of inventory get dropped on the second-hand market as people sell their cars to make ends meet or default on bank payments. Right now, consumers are being shielded by this thanks to significant efforts by banks to extend auto and other consumer loan payments by a period of 30 days.

The EV market is also at risk amid dropping oil prices and is incredibly vulnerable to more frugal consumers in comparison to its cheaper priced internal combustion competitors. Do you remember Tesla’s triumphant growth in stock price last February, which saw it reach a high of $917 a share? On March 18, its price dropped to $361 amid coronavirus and oil price concerns.

In the event that the crisis can be contained, the Philippines will need to look at the progress of its neighbors like Japan, China, South Korea, and Thailand who are responsible for much of the vehicles in the local market. If inventory can begin flowing in the short-term, then local brands may be able to lick their wounds and continue with business. Based on the discussions we’ve had with a few brands and several dealers; we were given assurance that the inventory they have on hand will be more than enough to satisfy the requirements of consumers once Metro Manila & Luzon’s enhanced community quarantine (ECQ) lifts.

In this event, we may experience a rapid acceleration in purchases spurred on by aggressive dealer marketing and a consumer “panic buying” mentality that is similar to the rush purchases of late 2017 (prior to the implementation of increased vehicle excise tax). If regional production is not back in full swing then Philippine consumers might experience longer waiting times when shopping for specific vehicles. Whatever the situation may be, one thing is for certain: dealers are not going to want to sit around with aging inventory, so expect there to be a good array of deals in the pipeline.

It's possible that some prospective buyers may already be anticipating a fight at the forecourt when the ECQ lifts as consumer interest levels online still remain healthy despite the lockdown. While carmakers and dealers have experienced a halt in sales, they need to look no further than the performance of online marketplaces to see that consumer interest is still there.

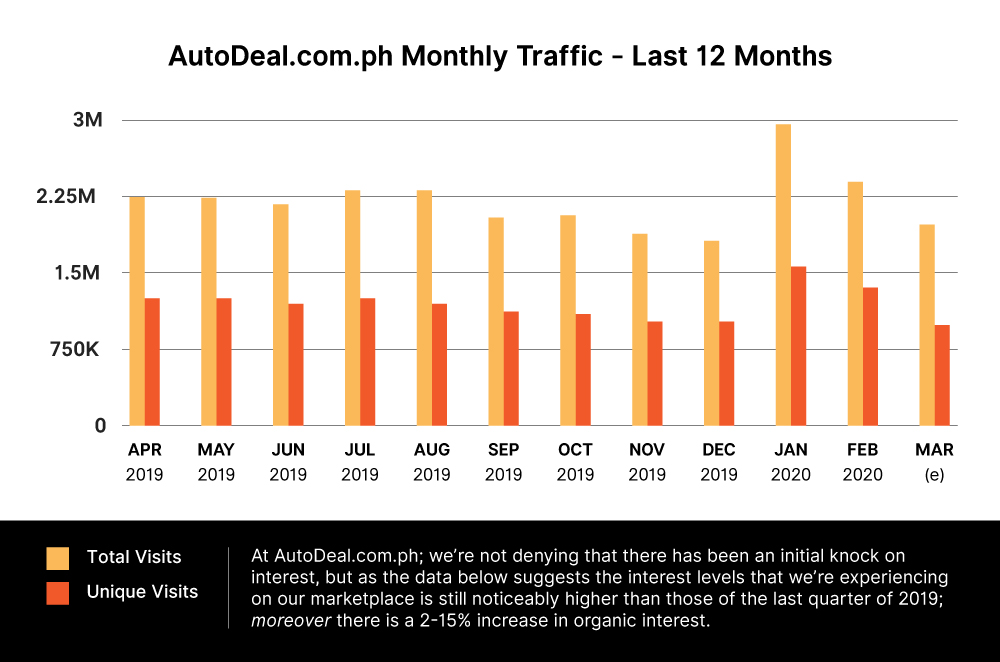

At AutoDeal.com.ph; we’re not denying that there has been an initial knock on interest, but as the data below suggests the interest levels that we’re experiencing on our marketplace is still noticeably higher than those of the last quarter of 2019; moreover there is a 2-15% increase in organic interest.

So, what does this mean for local car dealers?

While interest is high; engagement for specific brands and dealers is low. In a normal environment; interest and engagement typically go hand-in-hand – that is to say that if consumers are browsing, they’re also inquiring. The problem surrounding the current environment is the high level of uncertainty and while some groups haven’t done much to address this; others are majorly capitalizing on it - offering deals to incentivize customer reservations.

The trap right now is that dealers may focus too heavily on attracting new inquiries and may forget about all of the prospects who inquired in January and February – the likes of whom may have very well been intending to complete their purchases in March. Not only are these “customers in waiting” low hanging fruit for dealers; they’re also the low hanging fruit for all of their competitors. A lot of brands have made announcements to their customers (regarding servicing and warranty extensions); but how many are reaching out to their prospects?

Whether the economic consequences of COVID-19 to the buying public are heavily detrimental or not; a post-pandemic world is most likely going to drive the public desire for private mobility, meaning to say those that can afford cars, will continue to shop for them.

When we progress to a post-pandemic timeline, terms like “social distancing” and “contactless payments” will remain commonplace. Now more than ever vehicle companies need to embrace new lines of thinking, such as home test-driving, end-to-end online transactions and digital vehicle launches. Services such as Grab and Lalamove have been among the heroes of this crisis and the term “On-Demand” no longer just connotes convenience, but also safety.

As more industries look to embrace the ideology of on-demand services, the auto-industry must also strive to move in this same direction of progress.

Latest Features

-

How to prepare your car for the Holidays / Featured Article

Here are our handy tips on how to keep you on the road and stress free this holiday season.

-

An all-electric future: The Porsche Macan Electric / Featured Article

Porsche’s Macan goes all-electric; it’s a new beast with an electrified heart, yet unmistakably Porsche in performance and spirit.

-

Which Kia should I buy? / Featured Article

We’re here to help you decide which Kia vehicle is best for you, whether it’s a sedan, crossover, or minivan.

Popular Articles

-

Electric Vehicles in the Philippines for under P1 million

Jerome Tresvalles · Aug 19, 2025

-

Top 3 Cars For Every Lifestyle—What Cars Are Right For You? | Behind a Desk

Caco Tirona · Apr 24, 2024

-

5 Tips to Maximize Fuel Efficiency

Jerome Tresvalles · Sep 09, 2024

-

Five driving habits that are draining your fuel tank

Jerome Tresvalles · Jun 24, 2025

-

Can engine braking harm your engine?

Jerome Tresvalles · Sep 11, 2025

-

Do electric cars even need maintenance?

Jerome Tresvalles · Oct 23, 2024

-

Best vehicles for an active outdoor lifestyle

Shaynah Miranda · Jul 25, 2024

-

How to drive different types of vehicle transmissions

May 23, 2024

-

5 easy ways to keep your car interior clean

Allysa Mae Zulueta · Nov 15, 2021

-

How to survive Metro Manila traffic

Earl Lee · Aug 16, 2022