The Philippine automotive industry experienced a slow start to 2018 with negative year-on-year growth for the first quarter compared to the same time period last year. The result did not surprise most brands that claimed to have anticipated the slow start to the year because of the natural ‘pull-back’ that occurred when buyers became aware that the Tax Reform for Acceleration and Inclusion Program (TRAIN) could increase the suggested retail price of vehicles in most market segments.

Given AutoDeal’s unique ability to track car buying patterns, our data affirms the brands’ expectations and strongly suggests an end-of-year ‘sales rush’ due to a significantly decreased lead-to-sale conversion time and huge spike in sales transactions made by AutoDeal Partner dealers.

Following the release of our Q1 Auto Industry Insights report, more evidence has presented itself that further corroborates the ‘pull-back’ theory. The most notable of which could be drawn from the volume of mid-size SUV vehicles that were sold across the AutoDeal platform in 2017. As many of you will be aware, mid-size SUV’s were hinted early on to be one of the most at risk market segments from TRAIN.

From Q2 2017 to Q4 2017, the sales of mid-size SUV’s significantly increased on AutoDeal; growing from 16.43% of all transactions to as high as 36.75%. In Q1 2018, these figures have since dropped to account for only 14.4% of all transactions, suggesting what looks to be something of a market correction.

Further insights driven from the report also indicate that consumers might be doing more research or “buying their time” for a little longer ahead of making a purchase. This indicated by the consumers stated buying period, which is captured on every inquiry made on the AutoDeal platform.

Since the beginning of 2018, the volume of buyers stating that they were looking to purchase within 0-3 months has dropped from a high of 65.8% in December 2017 to 43.7% in January 2018. Likewise, the volume of buyers claiming to complete a purchasing with 6-12 months grew from 9.3% to 15.3% while buyers looking to purchase in 1-2 years increased from 3.7% to 7.4%.

Regardless of this, consumer interest does not yet look to have been completely extinguished as the volume of car-buying inquiries on AutoDeal saw little change (<1%) from Q4 2017 to Q1 2018.

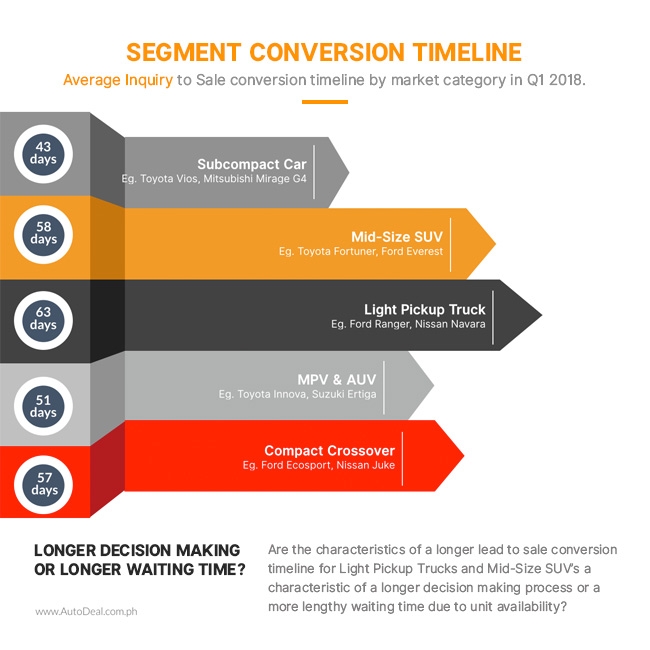

With this in mind, brands and dealers may need to adjust their strategy to convert prospects to sales over much longer periods than what they are currently use to. This will include (but is not limited to) improved lead-funnel management with particular focus on re-marketing and a solid prospect engagement schedule.

Foreseeing a more competitive environment and an increased need for a deeper prospect drill down, AutoDeal has included a prospect lead-funnel into its new analytics dashboard which provides dealers with the ability to segment prospects based on what stage of the buying process they’ve reached.

Latest Features

-

How to prepare your car for the Holidays / Featured Article

Here are our handy tips on how to keep you on the road and stress free this holiday season.

-

An all-electric future: The Porsche Macan Electric / Featured Article

Porsche’s Macan goes all-electric; it’s a new beast with an electrified heart, yet unmistakably Porsche in performance and spirit.

-

Which Kia should I buy? / Featured Article

We’re here to help you decide which Kia vehicle is best for you, whether it’s a sedan, crossover, or minivan.

Popular Articles

-

Electric Vehicles in the Philippines for under P1 million

Jerome Tresvalles · Aug 19, 2025

-

Top 3 Cars For Every Lifestyle—What Cars Are Right For You? | Behind a Desk

Caco Tirona · Apr 24, 2024

-

5 Tips to Maximize Fuel Efficiency

Jerome Tresvalles · Sep 09, 2024

-

Five driving habits that are draining your fuel tank

Jerome Tresvalles · Jun 24, 2025

-

Can engine braking harm your engine?

Jerome Tresvalles · Sep 11, 2025

-

Do electric cars even need maintenance?

Jerome Tresvalles · Oct 23, 2024

-

Best vehicles for an active outdoor lifestyle

Shaynah Miranda · Jul 25, 2024

-

How to drive different types of vehicle transmissions

May 23, 2024

-

5 easy ways to keep your car interior clean

Allysa Mae Zulueta · Nov 15, 2021

-

How to survive Metro Manila traffic

Earl Lee · Aug 16, 2022